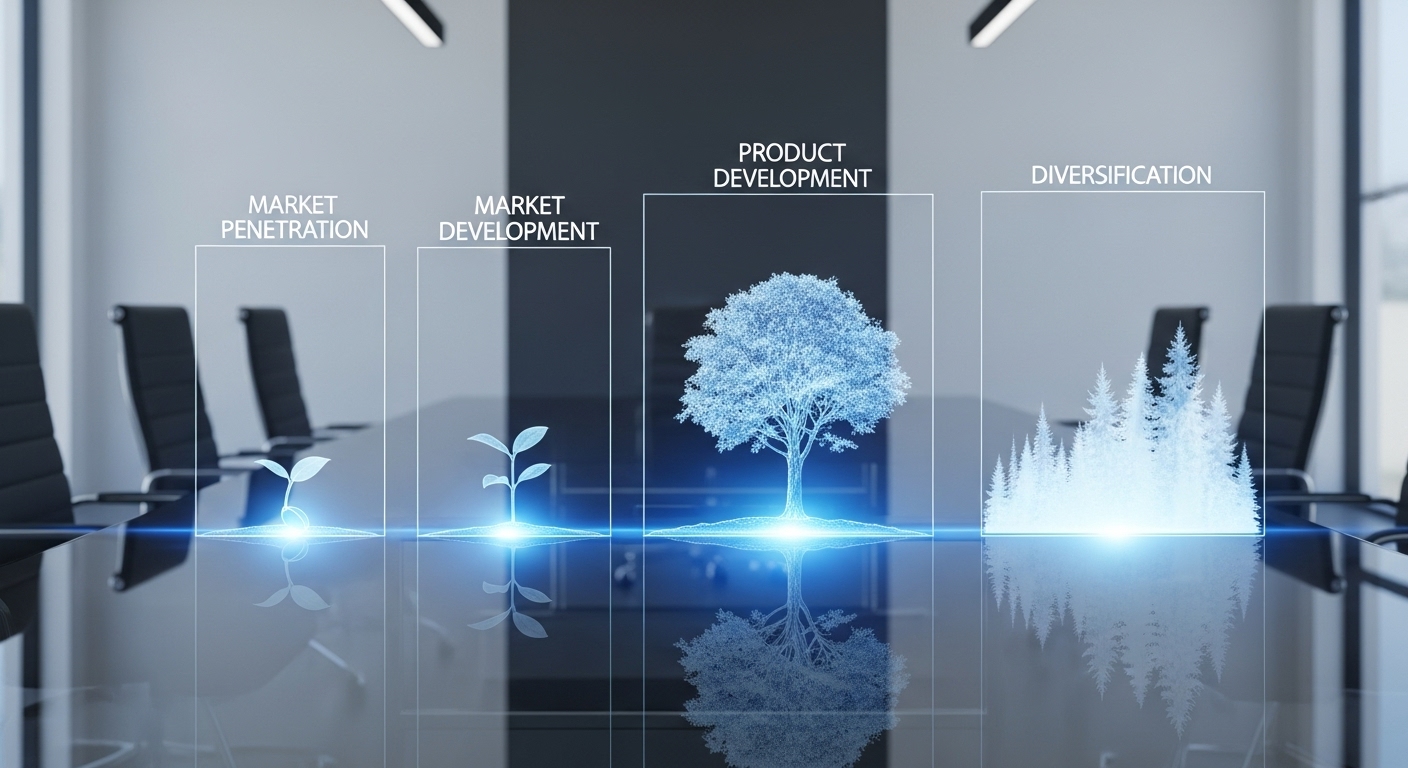

Choosing a path for corporate expansion is one of the most critical decisions a leadership team can make. It’s a move fraught with both immense opportunity and significant risk. In a dynamic global market, simply deciding to ‘grow’ isn’t a strategy; it’s a wish. The real challenge lies in selecting the right expansion model that aligns with your company’s current stage of development, resources, and long-term vision. Too often, ambitious startups try to run before they can walk, attempting complex international launches, while established enterprises remain stagnant, failing to innovate beyond their core markets. This disconnect between ambition and reality is a primary driver of failed growth initiatives. This guide cuts through the noise by presenting a clear framework: the growth continuum. We will explore how different expansion models—from focused market penetration to transformative mergers—are best suited for specific phases of a company’s life cycle, from the scrappy startup stage to the established maturity of a market leader. By understanding this continuum, you can make more informed, strategic decisions that pave the way for sustainable, long-term success.

The startup stage: Dominating a niche with market penetration

For any new venture, the first and most crucial challenge is survival and validation. This is the domain of market penetration, the foundational corporate expansion model focused on increasing market share for existing products within an existing market. It is the least risky approach, as it operates on familiar ground—known products, understood customer segments, and a defined competitive landscape. The primary goal is not to reinvent the wheel, but to make the wheel spin faster and reach more people. For a startup, this means going deeper, not wider. Success at this stage is measured by capturing a larger piece of the available pie through concentrated effort and tactical execution. This strategy hinges on operational excellence and aggressive marketing. Tactics often include strategic price adjustments, such as introductory offers or competitive pricing, to attract customers from rivals. Another key lever is increasing promotional efforts, leveraging digital marketing, content strategies, and targeted advertising to boost brand awareness and drive sales. Finally, optimizing distribution channels—whether through e-commerce enhancements, new retail partnerships, or a direct-to-consumer push—can significantly expand reach within the current market. A classic example is a local craft brewery that initially sells only at its taproom. A market penetration strategy would involve getting its beers into local bars, restaurants, and grocery stores, thereby capturing more of the local beer market without changing its product or geographic focus.

The scale-up phase: Exploring new horizons with market development

Once a company has achieved a strong foothold in its initial market through penetration, the natural next question is, ‘What’s next?’ When growth in the core market begins to plateau, it’s time to enter the scale-up phase, which is perfectly aligned with the market development expansion model. This strategy involves taking existing products and introducing them to entirely new markets. These ‘new markets’ can be defined in several ways: entering new geographic areas (expanding from a regional to a national presence, or making the first international leap), targeting new customer segments (a B2C company adapting its product for a B2B audience), or exploring new sales channels (a brick-and-mortar retailer launching a robust e-commerce platform). Market development is a significant step up in complexity and risk compared to penetration. It requires substantial research to understand new customer behaviors, cultural nuances, regulatory landscapes, and logistical challenges. A successful software-as-a-service (SaaS) company in North America, for instance, cannot simply translate its website and expect success in Japan. It must invest in understanding local business practices, data privacy laws, and customer support expectations. The reward, however, is substantial: unlocking entirely new revenue streams and diversifying the company’s customer base, making it more resilient to economic shifts in any single market. This phase is about methodical exploration, adapting a proven product to a new context.

The growth stage: Innovating from within through product development

For businesses that have successfully established brand loyalty and a deep understanding of their customer base, the growth stage often calls for product development. This model focuses on creating new or improved products for the existing market. Instead of finding new customers for old products, the company leverages its strong customer relationships and brand equity to sell new products to existing customers. This strategy is powerful because it builds on a foundation of trust. Your current customers already know and value your brand, making them more receptive to new offerings. Furthermore, the company can utilize its vast repository of customer data and feedback to inform the research and development (R&D) process, ensuring new products meet a genuine, pre-existing need. This significantly de-risks the innovation process compared to launching a new product in an unfamiliar market. A prime example of this is Apple. Having built a massive and loyal user base with the iPhone, the company systematically introduced new products like the iPad, Apple Watch, and AirPods, all designed to integrate seamlessly into the existing ecosystem. This not only created massive new revenue streams but also strengthened customer loyalty and increased switching costs. Success in this stage requires a strong commitment to R&D, a culture of innovation, and an unwavering focus on the customer’s evolving needs.

The maturity stage: Diversification as a long-term survival strategy

When a company reaches the maturity stage, its core markets may be saturated, and growth may have slowed to a crawl. At this point, relying solely on existing products and markets can be a recipe for stagnation and decline. This is where diversification becomes a critical strategy for long-term survival and reinvention. Diversification involves developing new products for new markets and is, by far, the riskiest of the Ansoff Matrix growth models. It requires the company to step completely outside of its comfort zone, navigating unfamiliar product technologies and market dynamics simultaneously. There are two main types of diversification. Related diversification involves moving into a new market with a new product that has some synergy with the existing business, such as a car manufacturer moving into electric bike production. Unrelated diversification, the riskier of the two, involves entering a completely new industry with no obvious connection to the current business. A quintessential example of successful diversification is Amazon’s evolution from an online bookseller to a global e-commerce giant, and then its leap into cloud computing with Amazon Web Services (AWS), a move that now accounts for a majority of its operating profit. While the risks are high, successful diversification can transform a company, open up vast new avenues for growth, and create a resilient portfolio that can weather downturns in any single industry.

The acceleration leap: Strategic alliances and joint ventures

Not every expansion model requires a company to go it alone. Strategic alliances and joint ventures are powerful tools that can be used at various stages of the growth continuum to accelerate progress and mitigate risk. Instead of building new capabilities from scratch or acquiring them outright, a company can partner with another organization that already possesses the desired expertise, market access, or technology. A strategic alliance is a formal agreement between two or more companies to pursue a set of agreed-upon objectives while remaining independent. This could be a technology company partnering with a large retailer to get its product on shelves. A joint venture is a more integrated approach where two or more businesses pool their resources to create a separate, co-owned business entity. This is common for international expansion, where a foreign company might partner with a local firm to navigate the regulatory environment and cultural landscape. The key benefit of these partnership models is synergy. They allow a company to achieve more, faster, and with less capital investment than it could on its own. For example, the historic partnership between Starbucks and Barnes & Noble allowed Starbucks to rapidly expand its footprint and access a desirable customer demographic, while Barnes & Noble enhanced its in-store experience. The success of these ventures hinges on careful partner selection, clear goal alignment, and strong governance structures to manage the relationship effectively.

The quantum jump: Growth through mergers and acquisitions (M&A)

For well-capitalized, mature companies seeking to achieve transformative growth almost instantaneously, mergers and acquisitions (M&A) represent the quantum jump. This inorganic growth model involves purchasing another company (acquisition) or combining with another company (merger) to gain immediate access to its market share, technology, talent, or product lines. M&A is the fastest path to expansion, allowing a company to leapfrog competitors and enter new markets overnight. An acquisition can be a strategic move to eliminate a competitor, acquire a critical piece of technology, or diversify a company’s portfolio. For example, Facebook’s acquisition of Instagram in 2012 was a defensive and offensive masterstroke, neutralizing a potential future competitor while gaining a massive, rapidly growing user base in the mobile photo-sharing space. However, this speed and scale come at a significant cost and carry immense risk. The financial outlay is often enormous, and the real challenge begins after the deal is signed. As studies frequently show, a high percentage of mergers and acquisitions fail to deliver their expected value. This is often due to a clash of corporate cultures, difficulties in integrating technology and operational systems, and a failure to retain key talent from the acquired company. M&A is a high-stakes strategy that requires meticulous due diligence, a clear and well-communicated integration plan, and exceptional leadership to navigate the complex human and operational challenges involved.

Ultimately, navigating the corporate growth continuum is a dynamic and context-dependent journey. There is no single ‘best’ expansion model; there is only the best model for your company, in your market, at this specific moment in time. The framework presented here—from the focused intensity of a startup’s market penetration to the transformative leap of a mature enterprise’s acquisition—serves as a strategic map. It illustrates a logical progression, where each stage builds upon the successes and capabilities developed in the last. A startup must first dominate its niche before it can dream of conquering new territories. A scale-up must secure new markets before it can invest heavily in broad product diversification. However, these models are not rigid, sequential steps. A company might pursue product development and market development simultaneously, or use a strategic alliance to facilitate either. The most successful leaders are those who can accurately diagnose their company’s position on the continuum, understand the risk-reward profile of each model, and execute their chosen strategy with precision and discipline. By matching your expansion strategy to your life cycle stage, you move beyond wishful thinking and begin to architect a future of deliberate, sustainable, and powerful growth.